You can convert YFI to other currencies like.

BeInCrypto is currently using the following exchange rate 6563.37.

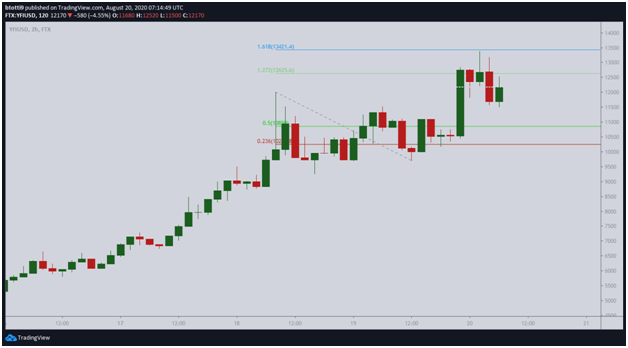

The members of the multi-signature wallet were voted in by YFI holders and are subject to change from future governance votes. The conversion value for 1 YFI to 6563.37 USD. Changes must be signed by 6 out of the 9 wallet signers in order to be implemented. Klicken Sie hier, um mehr YFI. Der gebruchlichste Weg, YFI.Mobi in USD umzuwandeln, ist ber eine YFI.Mobi(YFIM)-Brse. Trade cryptocurrencies with leverage Cryptos are available to trade with up to 2:1 leverage. A list of the top yearn.finance markets across all crypto exchanges based on the highest 24h trading volume, with their current price. At its weekly low, the YFI/USD exchange rate was as low as 17,605, according to data fetched from the. atch up on the recent YFI price in USD by following the YFI to USD charts at. The decentralized finance token formed an intraday high at 25,858 in the early trading session in London. Conversion: 1.00 yearn.finance (YFI) 6752 US dollar (USD) Foreign exchange converter and cryptocurrency converter. YFI.Mobi(YFIM) wurde an Multi-Krypto-Brsenmrkten notiert. Yearn Finance’s YFI rose by up to 16 percent in just two days of trading, even though its peers across the cryptocurrency market bled. Proposals that generate a majority support (>50% of the vote) are implemented by a 9 member multi-signature wallet. YFI.Mobi(YFIM) Preis ist 3.38 und hat ein globales 24-Stunden-Handelsvolumen von 43.18. Dato che tutti gli elementi sono chiaramente rialzisti, i trader potrebbero tradare soltanto le posizioni long (allacquisto) su YEARN.FINANCE - YFI/USD fino a. The Yearn ecosystem is controlled by YFI token holders who submit and vote on off-chain proposals that govern the ecosystem. This product completely optimizes the interest accrual process for end-users to ensure they are obtaining the highest interest rates at all times among the platforms specified above.

Users can deposit to these lending aggregator smart contracts via the Earn page. Funds are shifted between dYdX, AAVE, and Compound automatically as interest rates change between these protocols. The first Yearn product was a lending aggregator. End users also do not need to have a proficient knowledge of the underlying protocols involved or DeFi, thus the Vaults represent a passive-investing strategy. Vaults benefit users by socializing gas costs, automating the yield generation and rebalancing process, and automatically shifting capital as opportunities arise. The protocol is maintained by various independent developers and is governed by YFI holders.Ĭapital pools that automatically generate yield based on opportunities present in the market. On Monday September 14, our YFI-USD order book will enter transfer-only mode, accepting inbound transfers in supported regions. Yearn Finance is a suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain.

0 kommentar(er)

0 kommentar(er)